3,200 unit $230m multifamily portfolio foreclosure in Texas

The first of many or just a deal gone south?

If you haven’t already seen some of the news around social media, a 3,200+ unit class C multifamily portfolio in Houston, Texas just foreclosed in the last 2 weeks or so.

The point of this newsletter is to bring awareness to the news if you haven’t already seen it and try to consolidate some of the information and make sense of it. The point is not to point a finger, talk down on someone else, or do anything other than keep you informed.

Firstly, as of right now, I personally don’t see how rate cuts are going to happen in 2023. From my limited “keeping up with what is going on with the Fed”, they seem solely focused on fighting inflation and partially getting unemployment up. So far, neither seems to have moved enough for them to cut rates, and it wouldn’t shock me if there are some more 25-bps hikes this year.

I mention this because I think that we’ll see sustained interest rates through the end of the year if everything continues, which could mean more examples of what has happened with this portfolio.

A lot of deals in the past 3 years have been purchased with bridge debt, with a lot of those having floating rate debt and shorter terms. Floating-rate bridge loans require rate caps, which essentially prevent your rate from going above a certain point. This is great, except many of those caps expire before the loan term does which means you have to buy another. And now that rates shot way up, those caps cost a lot more, and/or your new rate cap or current interest rate will be much higher than it was with the prior rate cap. If you didn’t budget to purchase another rate cap, that could be a very costly bill the property and investors now have to absorb or pony up for (ie capital call).

Add on to that huge hikes in insurance premiums across the board (but especially for Florida, California, and Texas), wages continuing to grow (payroll expense), and labor and materials drastically increasing (repairs, maintenance, turnover, replacement reserves) and you have a lot of unaccounted for expense increases.

THEN add on to that rent growth across the nation is slowing, stagnating, or declining depending on your market.

What do you get when you add slowing or stagnated income growth with huge unforeseen expense increases?

NOI decreases and extra capital requirements.

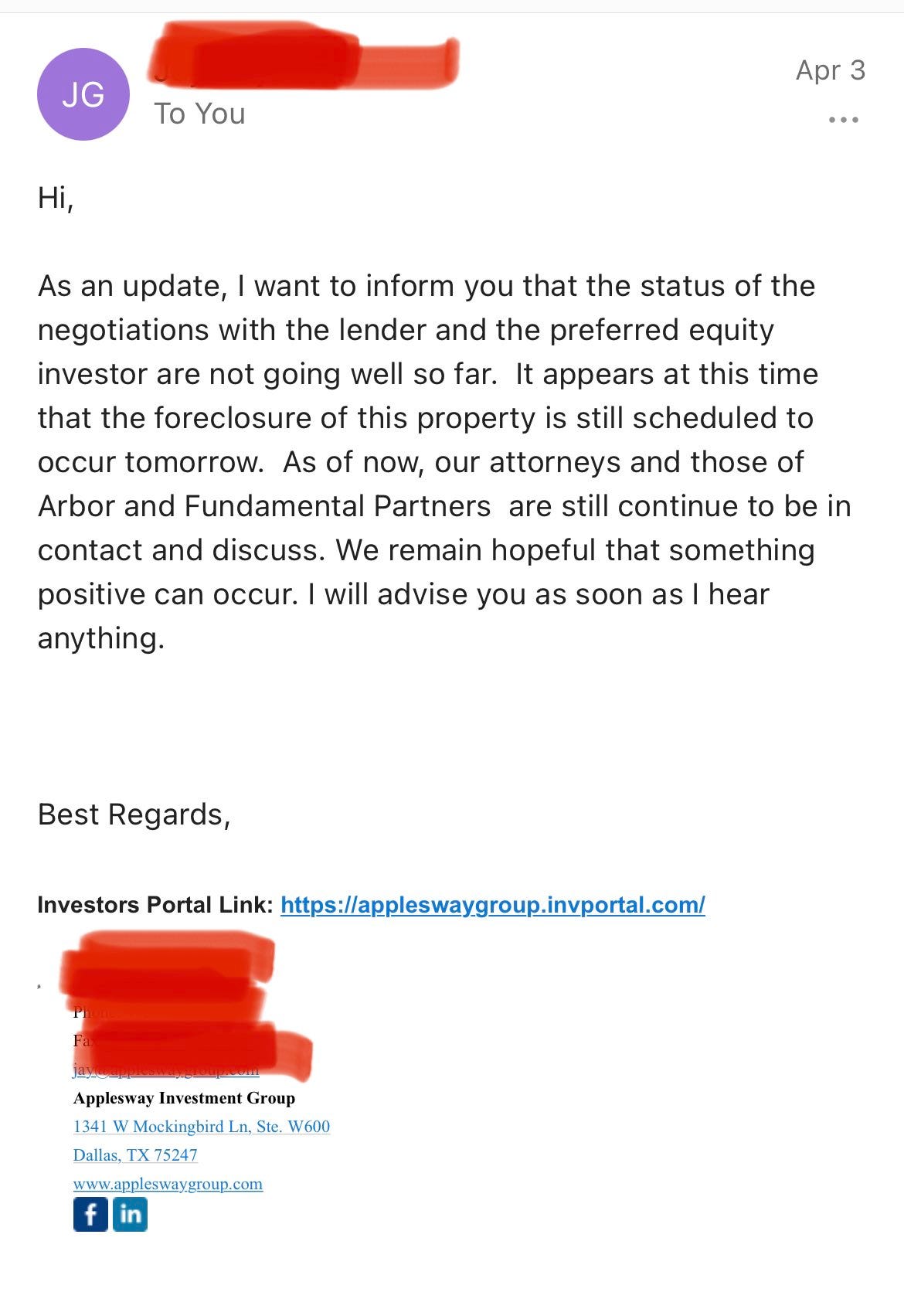

So onto this deal specifically, here is apparently the update that was sent out by the sponsor just before the foreclosure

And here’s a tweet from an LP in the deal

Sounds like some not-so-great investor relations if you ask me.

At the auction, the lender ended up taking back all 4 properties.

The credit bid placed by Arbor was $25 million cheaper than the principal amounts, totaling about $204 million for the four properties, according to ForecloseHouston.com. The lender won the bid and took over all four properties, with Heights at Post Oak being the most expensive at a final bid of $60 million.

-The Real Deal

Apparently, there wasn’t anyone there even trying to buy them.

I’ll be really curious to see what these eventually sell for and how Arbor plans on managing these properties in the meantime. If I were them, I would get them off my books ASAP because it doesn't sound like they were being operated well whatsoever and I would imagine it’s not going to be easy to right the ship.

Also, if it wasn’t clear, all the LP’s lost all of their money, 100% of it. I think they raised around $50m or so of equity from investors.

Then, add this salt to that already deep wound

Basically, some people are claiming the sponsor has skipped the country. For now, this is 100% a rumor in my eyes as I haven’t seen anything concrete to back this up, but he’s not the only person saying it on social media, and it wouldn’t surprise me if it did happen.

Another interesting thing I saw, here’s apparently another email from a different sponsor doing a capital call. This is apparently a different group, but I’m including it as I imagine this foreclosure portfolio had similar problems and this outlines it in more detail. (The 2nd image below was from the tweet in the first image, so I kept them together but had to separate them for formatting purposes)

So what does this all mean?

I think it means that there are some deals that are going to be in trouble.

Whether that’s capital calls, sales for a loss, cash-in refinances, etc. I’m not too sure, but right now a lot of sponsors are saying internally “Survive until ‘25”, which is a lot different than “You can double your money in 3 years if you invest with me” (I’m exaggerating, but also am I really?).

Also, I’ve heard from some other people I know through the grapevine that there are other groups who are starting capital calls too.

But, let’s also 100% be clear, we’ve been affected too, and I’ve had lower income and larger expenses than projected on our deals as well, but not to the levels of deals like this.

For our deals in 2022, we purchased with bridge loans as well, but we utilized lower levered bridge loans with 4-5 year terms and fixed rates. Whether that’s because we were a bit more conservative, had a bit more foresight, or plain dumb luck (that’s my vote), I’m not sure, but I’m not going to pretend either like our deals are the best thing since biscuits and gravy. (I live in Florida now biscuits and gravy is their sliced bread, and I don’t blame them)

My best understanding is this was a deal that had troubles with operations immediately after taking over and then got hit with a lot of expense increases on top of that.

So go check in with your sponsors, prepare for some decreased returns or losses, and work on positioning yourself going forward, I know we are.

All the best,

Chris Grenzig

Next time, maybe you should consult with a Counselor of Real Estate (“CRE”) before getting into such deals. CRE’s are some of the most qualified real estate advisors in the world and they can advise you on problems such as these- before you buy and lose your equity.