Florida Insurance Woes

If this is old boring news to you, I apologize in advance, because it’s certainly not breaking news. It’s been an ongoing, soul-crushing conversation I’ve been having, almost every day for several months. If you haven’t heard anything about it, or very little, welcome to a synopsis of our struggles with new acquisitions and blown budgets for our current deals.

So to quickly point out the severity of the situation in my direct experience in deals we’ve acquired or renewed:

Deals while at Toro

2017: $429 / unit (Ortega Village, 82 units)

2019: $350 / unit (Whispering Oaks, 128 units)

2019: $400 / unit (River City Landing, 320 units)

Mar 2020: $427 / unit (Park at Blanding, 117 units)

Deals while at JAG Capital

Aug 2020: projected $500 / unit (The Grove at Orange Park, 16 units)

Nov 2020: closed $800 / unit (The Grove at Orange Park, 16 units)

Feb 2021: $950 / unit* (Jefferson Square, 24 units)

Nov 2021: renewal $856 / unit (The Grove at Orange Park, 16 units)

Jan 2022: $929 / unit (Rubel and College, 20 units)

Feb 2022: renewal $1104 / unit * (Jefferson Square, 24 units)

Mar 2022: $982 / unit (River Breeze, 12 units)

Nov 2022: renewal $1629 / unit (The Grove at Orange Park, 16 units)

Jan 2023: renewal $1165 / unit (Rubel and College, 20 units)

Feb 2023: renewal $1850 / unit* (Jefferson Square, 24 units)

Mar 2023: renewal $1105 / unit* (River Breeze, 12 units)

Now: recommended assumption $1800-2000 / unit (any unit count, pre-2001)

A couple of notes before going on:

the property with an asterisk has partial flood insurance, so somewhat elevated more than the others.

Rubel and College have mostly small studio units, so less square footage means less premium.

River Breeze is our only concrete block construction deal, which also helps with the premium.

I didn’t include any renewals or recent info on Toro deals since I am no longer with the company, and only used it to highlight the extraordinary growth.

The size of the properties we do has had little impact on insurance premiums, as I download every book in town regardless of size to stay informed, I’ve also been underwriting deals up 200 units the past year, and I know many other owners with more scale who have premiums in the same range.

With all of that being said, the absolutely meteoric rise in insurance premiums in the last 12-20 months, has been nothing short of shit.

Bullshit, shit show, dog shit, you name it.

It has negatively impacted our operating budgets, it has negatively impacted the values of our buildings, it has hurt refinance scenarios, and it has made underwriting new deals incredibly challenging.

The main reasons we are having trouble underwriting new deals:

Values have not adjusted to the increased costs, mainly interest rates, and insurance

Even if a deal pencils with the increased costs today, I can’t realistically project our insurance costs 6, 12, 24, or 36+ months from now

And I know what you might be thinking, “You can never know what your costs will be in X amount of time”.

And you’re 100% right.

However, in years past, our “downside” was seeing a 5-6% increase in insurance versus 2-3% as projected.

Recently our insurance has increased 20-95% YOY!

So do I have to underwrite every deal with insurance increasing 100% for year 2 to feel comfortable? If that’s the case, no deal in the world is going to pencil right now

Do I pitch investors with a straight face that the worst is over and it’s only going to be 3%? I certainly can’t stand behind that right now and be able to sleep at night, so I won’t.

Even if I try to accurately judge (and by that I mean throw a dart blindfolder), is it 10%? 20%? 50%?

And then is that just for year 2? What about future years?

But here’s the real kicker.

I’ve been talking this over with hundreds of people, in all different facets, for over a year now. No one has answers.

BUT

A lot of the older heads in the space have gone through similar situations before! And what they say, is just like any other free market, it’s cyclical. There are run-ups and run-downs. So essentially, they think that eventually, insurance will fall again.

As more and more carriers leave the market (Farmers is the latest carrier to leave Florida) there is less competition. The thought is that eventually the extreme losses in Florida drop, or slow down. The companies that stayed start making great margins, and other companies look at the market and say we got to get into Florida, carriers come back to Florida creating more supply to meet the demand, and prices come back down.

How’s that a kicker?

I tend to actually believe that’s what will end up happening sometime in the next few years. It makes sense, it’s logical. If Florida gets decimated by hurricanes every year it might not, but I think it still will as of right now. (Totally could be hopeful optimism but I’m trying to balance that out).

So the kicker is if I believe insurance will eventually fall back down, shouldn’t I be thinking now is a good time to buy?

I actually somewhat do. I think if we found a relatively decent returning deal using conservative debt and assumptions, there is additional possible upside in insurance numbers coming back down.

But I can’t underwrite assuming it comes back down, and I can’t raise money on that thesis alone. Otherwise, I would project rent growth above 2-3%, or I’d project cap rates lower than today, or assume refinance interest rates would be lower.

Your underwriting has to assume more pessimistic than optimistic, and any scenarios that help your deal are icing on the cake.

That’s why you’ve seen sponsors return 30%+ IRRs the past few years because cap rates plummeted and rent growth was consistently very high.

There was a deal in Arizona and in Jacksonville, where a deal sold, then sold a few years later for a higher price, but the NOI was lower than when they bought it.

So buy something, it makes less money than when you bought it, and sell it for more.

Anyway, it’s not been an easy 18 months, but that’s why we haven’t bought anything since Mar 2022. Our deals are fine for the moment, we’re cash flow positive on them all, they all have 3+ years left on their terms, and they’re all fixed rate.

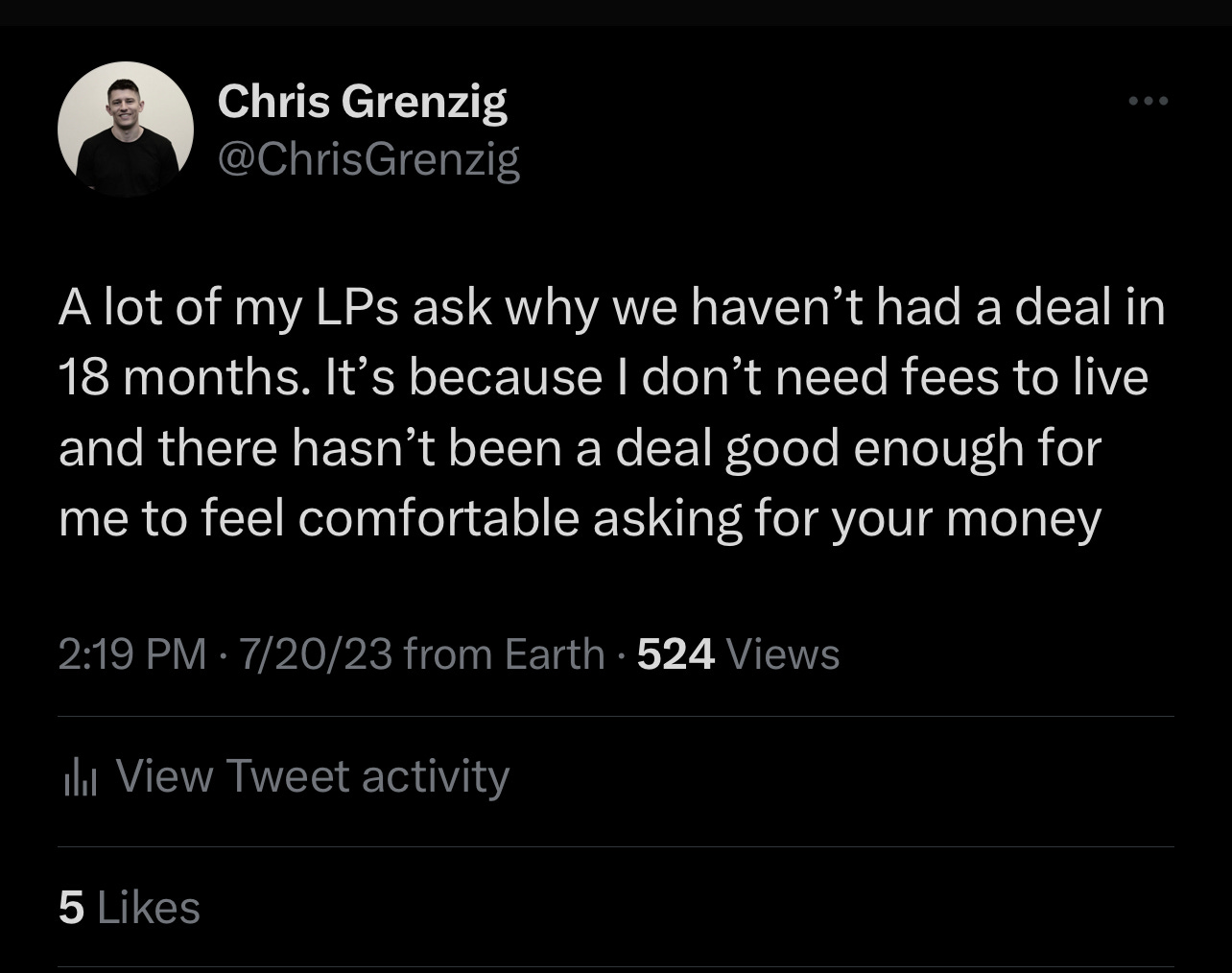

But that’s why I tweeted this yesterday:

(P.S. Follow me on Twitter for more consistent content and thoughts, click the image)

Anyway, it’s been an interesting year and a half, we’re exploring other options while remaining patient and active for more multifamily opportunities in and around Jacksonville. That being said, we’ve expanded to looking for deals from Charleston, SC down to Orlando, FL. You can read more about that in our next newsletter.

Until next time,

Chris Grenzig

JAG Capital Partners

JAG Communities