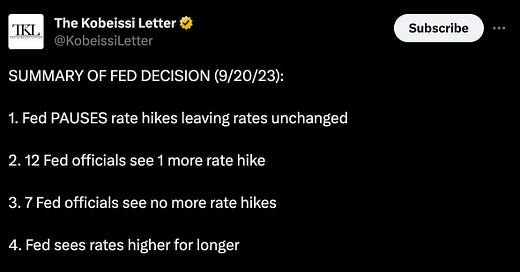

The Federal Reserve had its September meeting on Wednesday, September 20th, and the major news is no new rate hike.

But what do we take away from it all?

Fuck if I know

But here are a couple of interesting things I’ve seen more intelligent and knowledgeable people highlight from the meeting, and you can find my unqualified opinion towards the end.

It’s interesting to see here that there may be some indications that we have reached the potential top of the rate hikes for the foreseeable future.

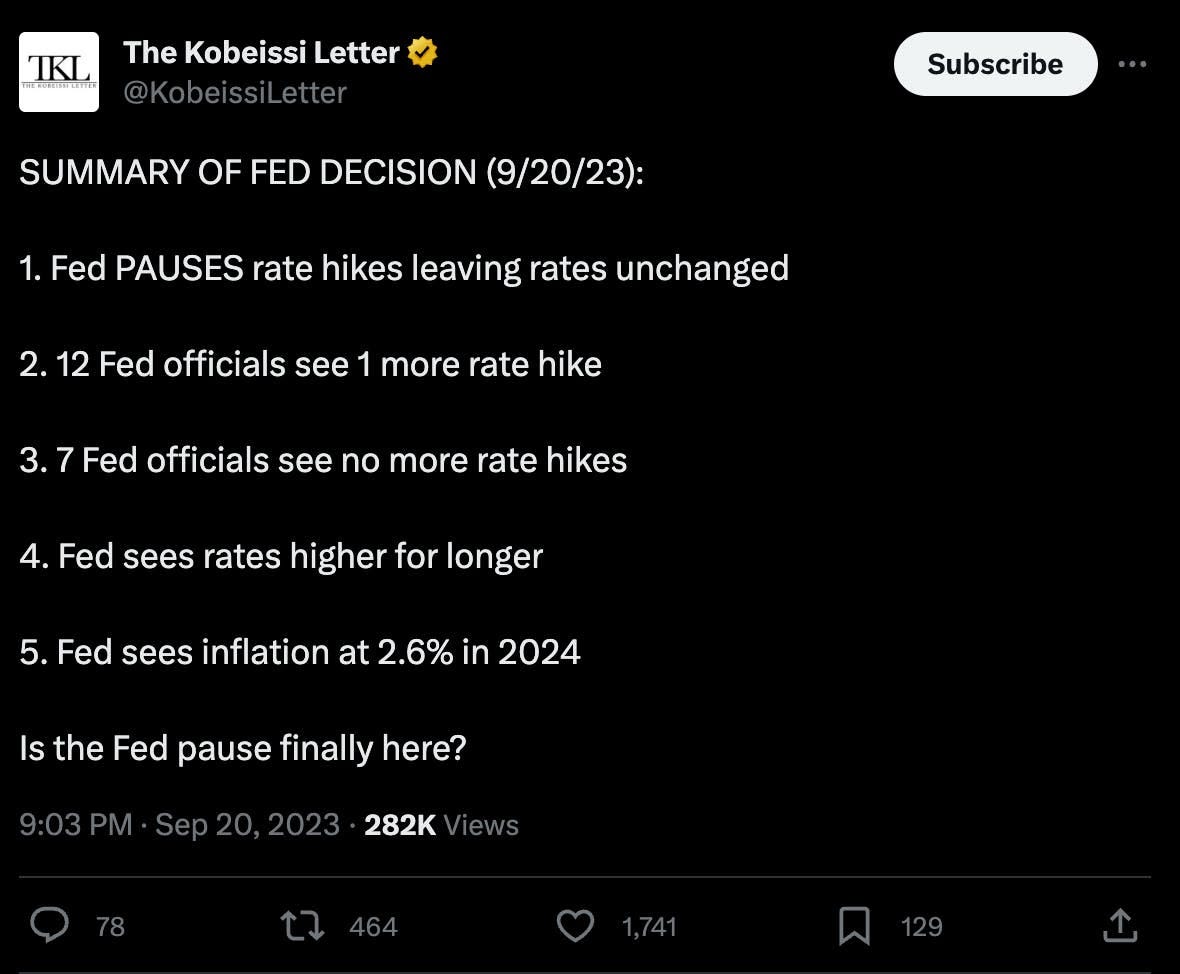

But if we’re being honest, I’m not sure I trust the Fed to do what they say they’re going to do.

Remember transitory inflation?

To be very truthful, I have not spent the time to verify that the Fed said anything of these things at the time they’re claiming to have said. But I definitely remember the first two.

But here’s the one thing that I will give them credit for, that I’ve always found confusing when people have said they’re expecting rate cuts this year or next year, and “the market” was supposedly pricing in cuts; the fed’s been very clear at what they’re looking at and tracking.

Inflation at 2%

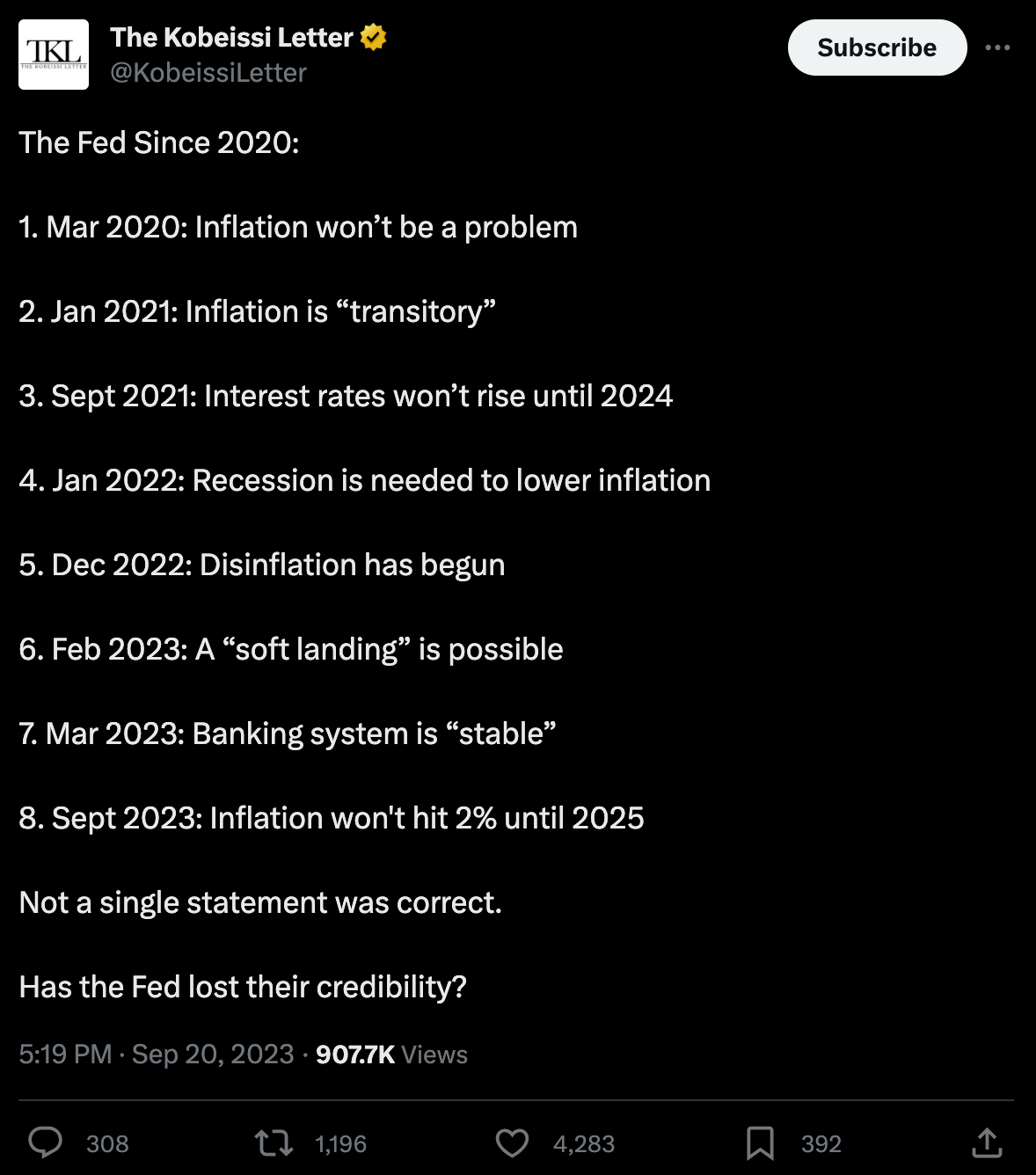

And I’ve yet to see anything that suggests we’re even close to that. And yet again here’s Powell from this past meeting talking about it more:

“Inflation has moderated somewhat since the middle of last year, and longer-term inflation expectations appear to remain well anchored as reflected in a broad range of surveys of households, businesses and forecasters as well as measures from financial markets,” Powell said.

“Nevertheless, the process of getting inflation sustainably down to 2% has a long way to go,” he said.

So when I see things like this:

I don’t get why anyone was expecting rate cuts

The only somewhat valid argument I’ve seen is the deficit growing exponentially because we’re borrowing at higher and higher rates and the Fed won’t want to force the US government to default.

Again, I’m no economist and I read this stuff fairly infrequently, so I’m not the most qualified, but it’s just odd how the most unwavering thing the Fed has harped on, hasn’t come close to being achieved, and people were expecting rate cuts.

So, what do I think?

First, nobody really knows, and I think it’s changing or decisions are being made on the fly. We are not in a period of much stability in where we are headed besides hitting 2% inflation from whatever data they deem appropriate.

Second, I think we have a high degree of likelihood of high-interest rates through next year. If nothing breaks and things keep trudging along the way they have for the past 12 months, then I don’t see how they make any rate cuts.

What does that mean for real estate?

Either buyers are going to get comfortable buying negative leverage deals and underwriting to exit at negative leverage deals, or pricing is going to see some pretty big shifts downward.

If you bought a deal for a sub-5 cap and projected a sub-5.5 cap exit, had a UYOC under 7, and you’re fighting all the downward pressures on income and upward pressures on expenses, you’re going to be in for a big shock on what new pricing will be if the market doesn’t accept negative leverage.

If it does, then maybe those deals will be okay.

There are two portfolio sales in Jacksonville right now consisting of 1000+ units that I’m tracking closely, one of which definitely has to sell and will meet market pricing.

But, it will be a good indication because I was using a 7% cap exit with flat rent growth, and I was probably closer to 40-50% lower than their asking price, so the only way I see those getting bought is if someone is projecting insane income growth, someone is projecting decreased expenses (mainly insurance), or they’re expecting a negative leverage exit and/or expecting rates to fall so it’s no longer negative leverage.

Anyway, we continue to watch what happens and be active in our search for opportunities, but it wouldn’t surprise me if things got much worse for investors before it gets better.

If you’re interested in possibly investing with us or seeing future opportunities, click the button below and join our investor list.

All the best,

Chris Grenzig

Owner

JAG Capital Partners | JAG Communities

Chris@jag-communities.com