Silicon Valley Bank, my jumbled thoughts and questions

Your Friday isn’t looking quite as bad now is it?

If you’ve seen the news, then you know that Silicon Valley bank got shut down by regulators earlier today. I’ve seen it called anywhere from the 6th to the 20th largest bank in the country and labeled as the 2nd biggest banking collapse in our history. As someone who lived through the 2008 crash but wasn’t quite yet a legal adult, I have nothing to compare this too, so I have very little opinions to share, if any, some thoughts, and a whole lot of questions.

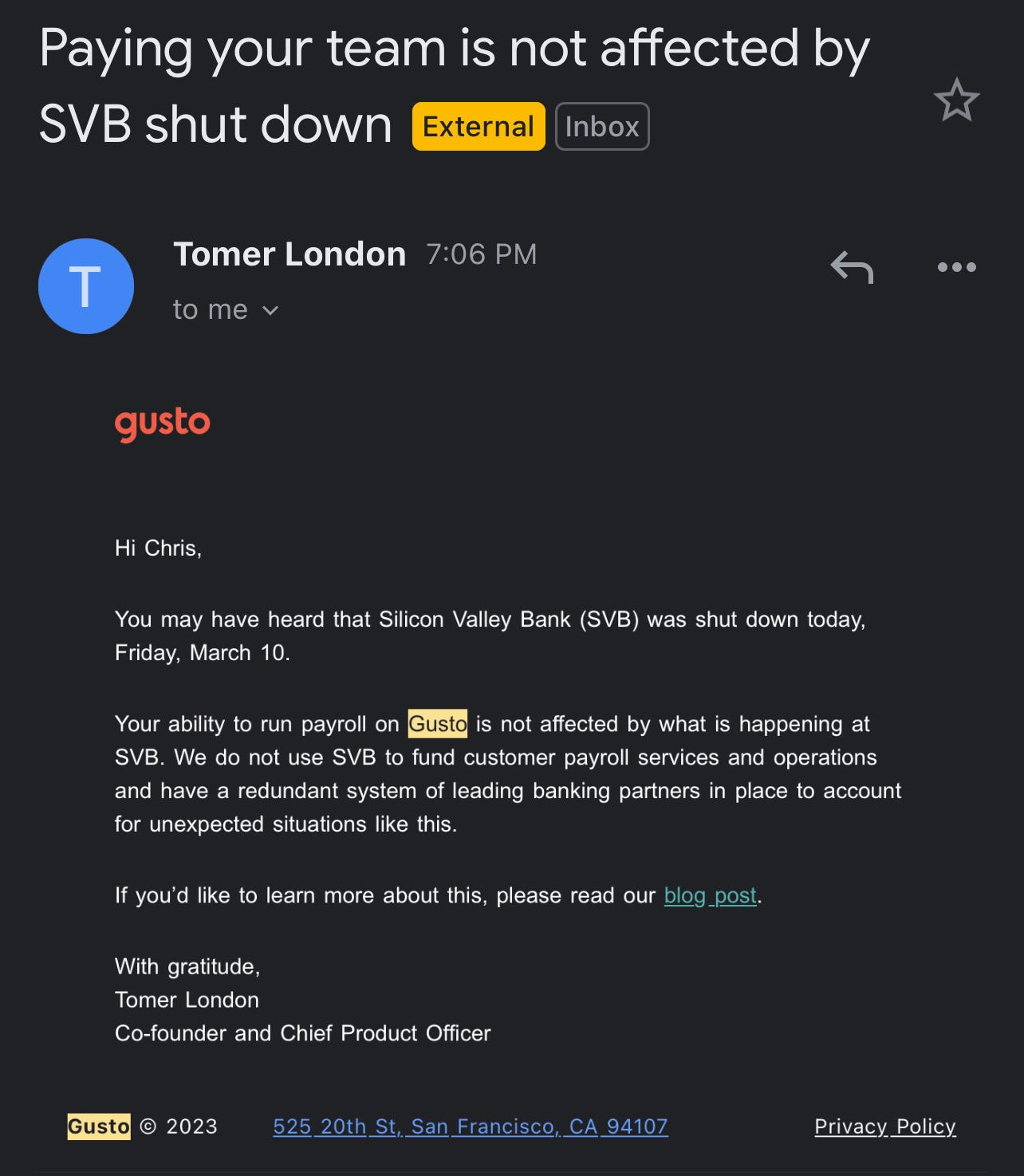

Let’s start with the good news, so far our properties and investors haven’t been directly impacted by this, but who knows how that unfolds. Our employees have also not been affected as Gusto put out this email earlier today

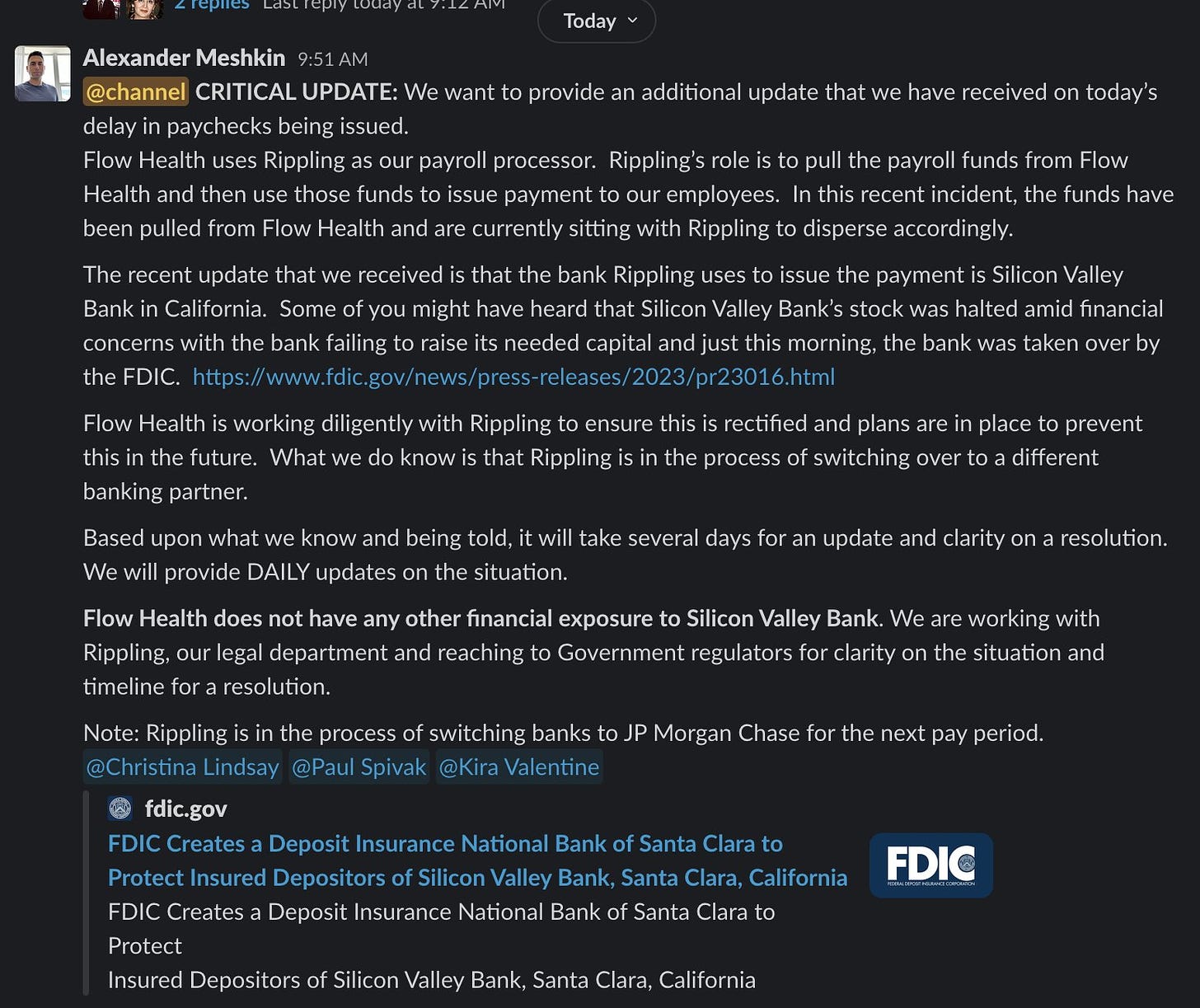

Well that’s good to know from a business owners standpoint because not everyone is as lucky. Case and point:

So now we come to what’s this all mean.

Well for starters obviously anyone with money in SVB right now has got to sit tight. On the very small bright side, SVB is too big that there won’t be a ton of people working around the clock all weekend to try and clear up this clusterfuck by Monday. Let’s see how that plays out. Then there’s the people or companies who have more than the $250k FDIC limit. Roku has close to $500m deposited at SVB and is unsure how much it will be able to get, if any. Luckily it’s only 26% of their cash holdings, but still that is crazy.

So basically a ton of money is going to be inaccessible for some period of time and the longer that goes on, the larger the trickle down or out effects are going to be. If companies can’t make payroll, then people can’t pay their bills or spend money, and you see where I’m going.

Some companies are going to extreme measures to come up with quick cash to pay their payroll and bills.

Ben Kaufman, former CMO at BuzzFeed and the founder of experiential toy store Camp, e-mailed customers this week asking them to purchase more from the company’s site, according to a screenshot sent to TechCrunch. The whimsical discount code resulting from the situation was quickly shared around Twitter.

“Camp needs your help,” the email starts. “Unfortunately, we had most of our company’s cash assets at a bank which just collapsed. I’m sure you’ve heard the news.” Kaufman then told people sales from this point forward will deposit into Chase and “allow us to generate the cash needed to continue operations so we can continue to deliver unforgettable family memories.”

Camp is offering 40% off either a lot of their products or store wide. Pretty smart if you ask me, getting a bunch of publicity and a creative way to (potentially) come up with some cash.

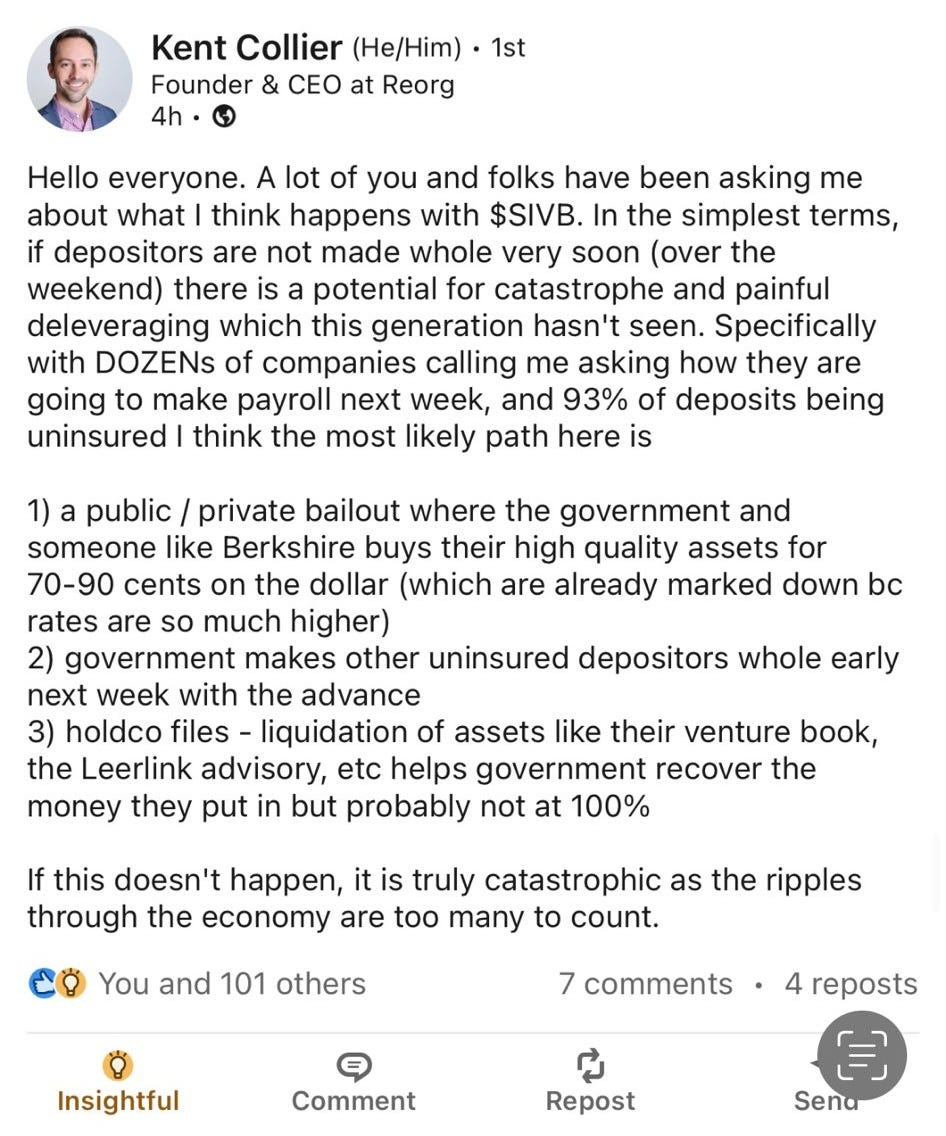

So what happens? I have no idea, but I saw this following post on LinkedIn and felt like it made some sense:

So maybe we see some sort of a bailout? Wouldn’t surprise me as I can’t see the administrations risking not stepping in and getting people they’re money back and being almost universally hated overnight.

What I’m curious about is how does this affect Fed, CPI, and interest rates. The 10 year treasury is down just over 20 bps just today, and is down around 30 bps from earlier this week. Obviously this isn’t correlated to the fed funds rate and I don’t think indicates what the fed will do, but is this a catalyst that pushed the economy to higher unemployment and lower CPI? Does significantly less cash in circulation curb spending and force Powell and co to curtail rate hikes? Or does this lead to greater levels of fear and push us deeper into a recession or into a recession? (with the changing definition of a recession who even knows anymore).

I have so many thoughts and questions and so little answers, but I see very little ways this is a good thing, except maybe our refinance we’ll time the treasury nicely and get a bit of a lower rate. Or who knows maybe we’ll lock in a high rate now and the fed will start back up QE and rates will drop back down.

I definitely don’t have the answers, but I don’t see this making things better in the short term.

Enjoy your weekend, because there are plenty of people in the country who definitely aren’t enjoying there’s.

(I posted this from my phone without really proofreading so forgive any written sins I may have committed)