To be honest as I write this I don’t have the most concise idea or point, moreso a general topic I want to cover.

And that is, that NOI’s are being negatively impacted right now in a meaningful way because income is down, expenses are up, and cap rates have expanded.

Good chance if you bought a 3-4 cap deal in 2021-2022, you’re fucked.

(Unless of course you could 2-3x your NOI, which is entirely different, but let’s be realistic)

Multifamily in general has struggled the past 2 years.

Some of the big factors are:

Interest rates doubling

Rent stagnating or dropping

Construction costs doubling

Cap Rates expanding

Expenses increasing

Vacancy ticking upwards

All of these help push income down and expenses up, which lead to lower NOI’s.

I wrote a quick twitter (now called X?) thread about this the other day if you want to read more.

Click Here to read the whole thing

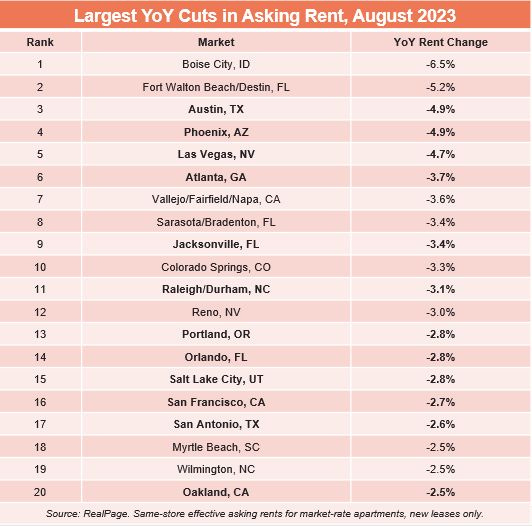

Jacksonville, FL has probably gotten the worst end of the stick, or dang near close to it. It’s currently ranking in the top in the country in several areas, and not in the best sense.

So let’s start with rents:

That’s right folks, rent doesn’t always go up. In case you can’t find it, Jacksonville for Aug 2023 sits at 9th in the country with YOY change of -3.4%.

Now if you look over a longer term horizon of 3-5 years I’m sure rent growth per year is still very high, but if you bought a deal the last 2 years and we’re banking on 3%, 5%, 10% per year or any year, well kiss those sweet returns good-bye (for now).

But that’s not all!

Let’s move on to Economic Vacancy

Economic Vacancy encompases and losses that affect rental income or impact the properties ability to hit it 100% of it’s possible rent, also called Gross Potential Rent

(If I have 10 units that the most I could charge is $1,000, my GPR is $10,000 per month)

Economic Vacancy includes many things, but let’s talk about the most important 3 when it comes to the market:

Physical Vacancy, Concessions and Bad Debt.

In Q1 2023 Physical Vacancy is up to 6.5% in Jacksonville from 5.4% in Q3 2022 and 2.8% in Q4 2021, per NAI Hallmark

Concessions are up to 3.4% in Q1 2023 from 2.3% in Q3 2022, and 3.1% in Q4 2021 per the same source.

In my personal experience, outside of new construction, there wasn’t much concessions being offered in Jacksonville from 2019-2022 except maybe during the early days of covid. And I know for sure, no one was underwriting for any concessions.

Unfortunately, for Delinquency, in my quick searching for data, I didn’t find any numbers. However, 2 years ago people used maybe 0.5-1%, and I have seen a dozen or more C class deals in the past with delinquency anywhere from 1% all the way up to 20%.

So lets says Q4 2021 was 2.8% Vacancy, 0.5% concessions, and 1% delinquency for arguments sake, that totals to 4.3%

Now we’re seeing 6.5% vacancy, 1% concessions and let’s say 2% delinquency, for a total of 9.5%.

I’m cherry picking a little bit, but thats doubling the economic vacancy, thats a massive difference!

My point is, gone are the days of 1% Loss to lease, 5% physical vacancy, 0% concessions and 0.5% delinquency.

And anyone who underwrote with those assumptions, you’re now being negatively affected by rent growth and economic occupancy.

If you’re interested in possibly investing with us or seeing future opportunities, click the button below and join our investor list.

So we know this is happening to income, but why?

We can definitely attribute part of this to new supply in the market. Jacksonville is one of the top markets in the country with new supply coming online, both in overall numbers as well as a percentage of existing supply.

This excerpt from Matthew’s Apr 5th Jacksonville Multifamily report does a nice job of explaining it.

Credit: Matthews Real Estate Investment Services

It’s a little small for those on phones, but here’s the main excerpt:

“Jacksonville is experiencing one of its largest influxes of new supply in history, with a 20 percent increase in market-rate multifamily inventory over the past five years and an additional 10,000 units currently being constructed, representing a 9.3 percent expansion of the inventory.”

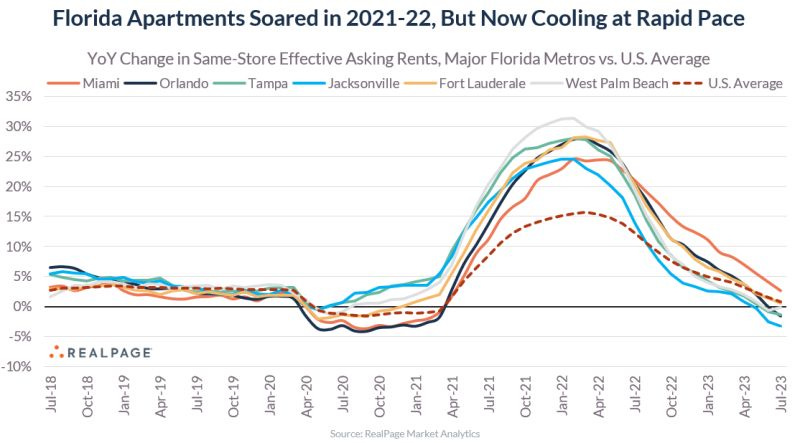

Or this from Jay Parson’s at Real Page

“Jacksonville was the first big Florida market to cool off, as it's one of the national leaders in apartment construction with a remarkable 11% expansion rate. Effective asking rents fell 3.3% year-over-year through July, one of the deepest cuts nationally.”

So we have income grinding to a halt or dropping depending on the submarket and the property itself.

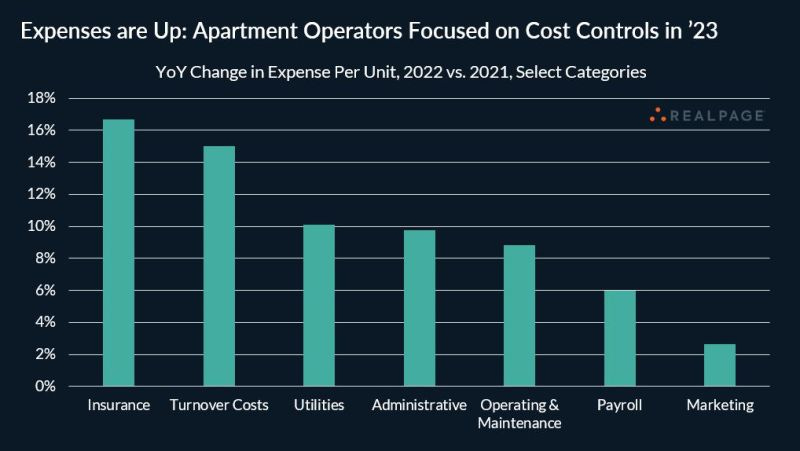

Let’s hop over to expenses, shall we?

Credit: Jay Parsons Real Page

So, a lot of expenses are increasing, but with Jacksonville, that insurance number isn’t 16-18%, it’s more like 100%+!

I already touched on insurance in detail in a previous post here, but to summarize insurance was in the $350-450/unit range in 2017-2019 and is now in the 1600-2300/unit range today. From my own experience its a 100% YOY increase roughly and a 450-600% increase from 2017 to todays numbers!

And this doesn’t even touch on interest rates expanding, which if you used a floating rate loan lately, your interest rate went up. Even if you bought a rate cap, a lot of people bought caps with a shorter term than their loan term, so they’re having to fork over huge premiums for new rate caps, at even greater ceilings!

All of this leads to flat or lower NOI’s, or at least lower than projected, coupled with higher current or future financing costs, AND expanded cap rates.

Which is why we’re seeing more and more deals selling distressed and some are starting to sell for less than what they were purchased for in the last couple of years.

In the last month alone I’ve seen 10-12 properties of varying sizes and submarkets, totaling close to 1500 units, that I would classify as distressed in one form or another.

However, this is why we have always focused on solid assets in solid locations, and generally avoided class C/C- assets.

Fortunately, we’ve been 100% collected for 2 years minus one tenant skipping across 72 units. We’ve been over 90% occupied, and I don’t believe we’ve had to offer any concessions in that time either.

(Of course I typed this comment about only have 1 skip yesterday and this morning as I edit I get a text saying we probably have another skip 🤦♂️)

However, in the last couple of months we’ve definitely had to drop asking rents 2-5% depending upon the deal, and that has not been fun.

We’ve also had insurance premiums rise anywhere from 20-80% YOY. And our 1st property has doubled since Nov 2020 to today.

(Our renewal coming up in November of this year is going to be fun)

I’m never going to pretend we haven’t been affected, but so far we’ve been largely fortunate to continue to operate in the black and be largely unscathed.

How the market goes the next couple of years will largely impact how well our deals perform that we acquired in 2020-2022.

But if you’re wondering why we can’t find a deal that works, or maybe why a deal you invested in isn’t doing as well as everyone hoped, hopefully this helps paint a better picture of why.

If you have any more insights, or if you want to discuss this in greater detail please shoot me an email or if you have my cell already call/text me. I don’t think this is going away anytime soon, so we’re holding on for an interesting ride over the next 1-3 years.

Chris Grenzig

Owner

JAG Capital Partners | JAG Communities

Chris@jag-communities.com